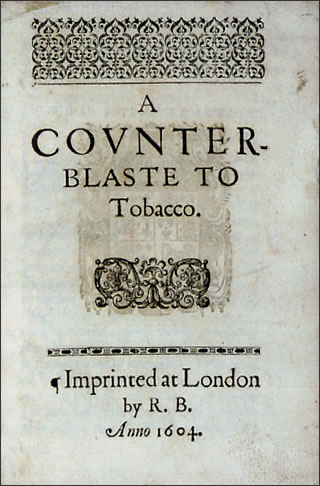

In the early seventeenth century Scotland’s King James came to power, succeeding Elizabeth I to the crown of England. James was a great moralist and high on his list of Things to Purge were the Antichrist, Witches, their assorted demonic consorts, and henbane of Peru, otherwise known as tobacco. Witches could be tortured, tried, and burnt. Demons and tobacco posed a slightly greater challenge, so James began his campaign with a war of words. In 1604 his Counterblaste to Tobacco was published and became one of the world’s first diatribes against the gentle art of smoking.

It didn’t work. Whether it was a witch or a fine pipe of Virginia leaf, Englishmen continued to light ’em up. So James took the next inevitable step: taxation. Maybe it was a shrewd play for more revenue, or perhaps a legitimate concern for the souls of his subjects. In any case, the duty on tobacco was raised 4000 percent.

4000 percent, you say? Holy smokes! That’s a rather extravagant raise, if I do say so myself.

And yet that’s nothing compared to what the United States Congress is preparing to do to cigar enthusiasts in 2008.

What would you say to an increase of 20,000 percent? That is the cap on the tax that lawmakers are considering placing on sales of cigars to United States citizens. The current federal excise tax is about a nickel per cigar. The proposed increase is to 53% of the manufacturer’s sales price, with a cap of 10 dollars per cigar. (In addition to state tobacco taxes, sales taxes, tax taxes, etc.)

This isn’t the first time that Congress has threatened the cigar industry (remember the American Jobs Creation Act?) but this new thing looks even more dangerous – and likely – because those who will supposedly benefit are poor kids. The revenues from this gargantuan tax increase are slated for the renewal and expansion of the State Children’s Health Insurance Program, a program which has in the past received largely bipartisan support. Let’s face it: as an elected representative from either side it’s going to be hard to vote down benefits for children.

And look. I’m not a hard-hearted guy. I’ll take a hit for the kids. Hell, raise the tax to a quarter. That’s a 500 percent increase, and based on my consumption it would make my annual contribution about a hundred bucks. I don’t mind a reasonable tax on my hobby for a good cause, but is 50% of the wholesale price a reasonable tax? King James didn’t go that far and he was chasing the Antichrist and his pipe puffing minions!

Cigar sales make up 8 percent of total tobacco expenditure in the United States. 90 percent of total sales are of cigarettes. Under this plan cigarette taxes will increase as well, but only by a “modest” 61 cents per pack, an increase of less than 200 percent. Meanwhile taxes on premium cigars will go up by 2 or 3 dollars on average, with the super premiums getting totally clobbered. Why is this tax so disproportionate? Why are cigar smokers getting the shaft?

And there are other considerations, aside from the basic unfairness of the tax:

- Cigar shops, especially small mom and pop establishments, will be put out of business with a floor tax that will require them to pay this tax up front on all their current stock when the law goes into effect.

- More than likely a new black market will emerge, and what will be the costs of policing that?

- Struggling economies in Central America and the Carribbean that are just now recovering from years of political repression and the effects of hurricanes will be adversely affected when cigar exports are curtailed.

- What happens to the revenues for SCHIP when the industry being taxed shrivels up or goes underground? How wise is it to rely on a moribund industry to fund health insurance for the youth of America?

A lot of the commentary on the cigar boards has had a political bent blaming the democrats for this proposal, but the only way this bill will pass is if republicans join in with the democrats to override a Bush veto. A majority of republicans on the Senate Finance Committee voted with the democrats today to send this proposal to the full Senate. If successful this will be a bipartisan screwing. Regardless of where you or your representatives stand politically, let them know your opinion on this twenty first century Counterblaste.

You can contact your Senator by clicking here.